Every EFTPOS terminal in the country is programmed with a unique number that links the transactions to a bank account through a secure payment network. The primary number is called the Merchant ID (or MID) and is essential as it is an identifier unique to your business.

How do I get one?

In New Zealand, you can opt to hold a merchant ID on the Verifone payment network, or the Worldline payment network.

Worldline is the more popular of the two and is Eftpos Now’s preferred network due to its versatility and compatibility with a broader range of EFTPOS terminals. If your company structure is simple such as a sole trader or limited liability company, we can guide you through the application process and apply directly to Worldline on your behalf.

Merchants who fit into the following categories are encouraged to apply directly to their banks (via the bank’s merchant services department) to obtain a merchant ID number. This is due to the slightly more complex onboarding process:

- Clubs

- Associations

- Societies

- Complicated company structures i.e trusts

- Taxis (incl sole traders)

- Schools

If you have an existing Verifone merchant number (12 digits), we have EFTPOS hardware in our fleet that works perfectly with this specific network.

Terminal IDs

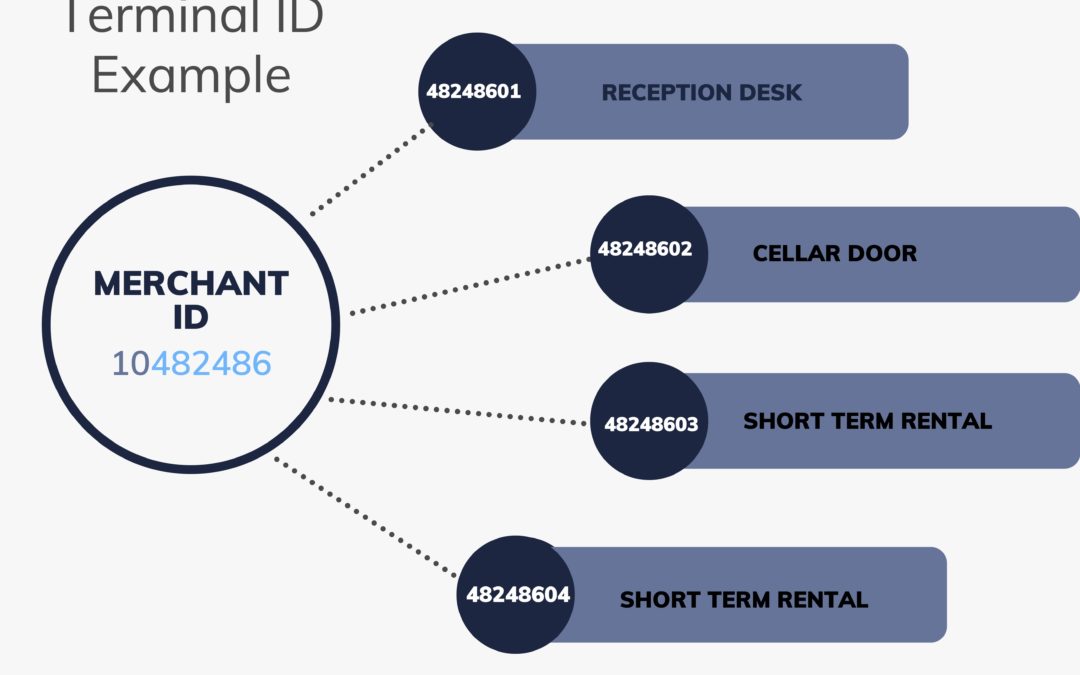

A terminal ID (or TID) is a number that branches out from the merchant ID. If you think of the merchant ID as the fixed umbrella number for your business, then every EFTPOS terminal in your business will have its own terminal ID (or lane, as it is sometimes referred to).

Using a Winery as an example (see illustration) the merchant ID is a fixed 8-digit number. The terminal ID for each EFTPOS machine in the business is very similar to the merchant ID but has a suffix of 01, 02 and so on depending on the number of terminals in use.

Note that two EFTPOS terminals cannot share one terminal ID.

It is most helpful when renting or purchasing an EFTPOS terminal from Eftpos Now, that your merchant ID and relevant number of terminal IDs are active and ready to program into the EFTPOS terminal(s) before dispatching from our offices.

How much will a Merchant ID cost?

Maintaining a live and active merchant ID comes with a cost. Every live terminal ID on the Worldline network is provided at a cost of $18.90 + GST per month. In the Winery example, they would be charged 4 x $18.90 + GST in network charges. This cost remains the same whether you apply directly to Worldline or via your bank because every terminal ID holder is subject to the network fee.

EFTPOS only transactions are free in New Zealand (when the card holder swipes or inserts their card and chooses Cheque or Savings). Introducing Paywave and credit card facilities to each Terminal ID will incur merchant fees. The rates for each scenario are often variable so it pays to familiarise yourself with your bank’s rates. Tracking your transaction values and payment methods will further assist you with determining what facilities are most relevant to your business needs.

Questions?

If you’re still scratching your head, please call Eftpos Now and we can further demystify Merchant IDs, as this aspect of our business often produces the most questions. Once mastered however, everything else is a walk in the park.